Introduction

Navigating the monetary landscape can continuously feel like a daunting assignment, highly for homeowners grappling with mortgages and latest accounts. In the UK, many discover themselves in scenarios the place handling distinctive money owed becomes overwhelming. Fortunately, there's an answer that could give comfort: secured loans. For those with poor credit score, secured loans latest an alternative to consolidate debt and regain handle over their monetary lives. In this newsletter, we’ll explore how UK house owners can unencumber economic freedom because of secured loans for debt Frequent Finance SW15 consolidation, in Frequent Finance Brokers spite of the fact that they've got a less-than-stellar credit history.

Secured Loans: A Comprehensive Overview

What Are Secured Loans?

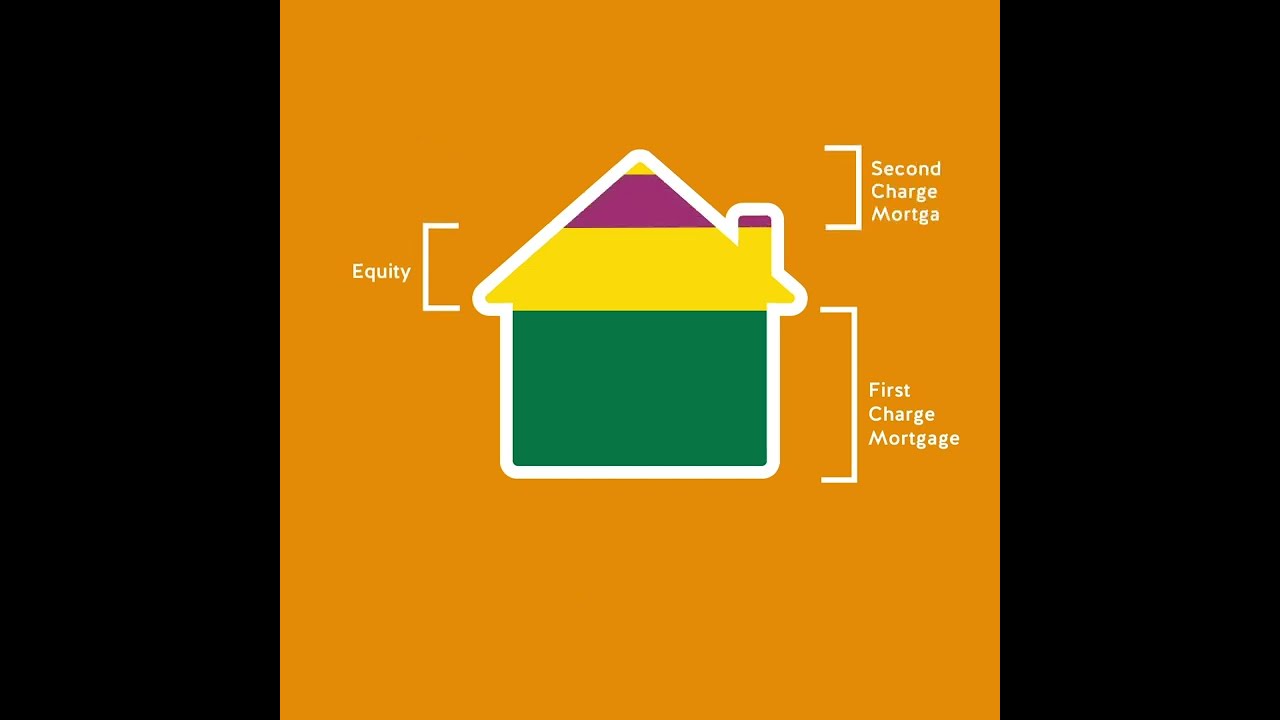

Secured loans are financial products that require borrowers to put up an asset as collateral. This might possibly be your property or other crucial belongings. Because those loans are sponsored by way of collateral, lenders in many instances provide lower curiosity costs than unsecured loans, making them Frequent Finance in England an desirable option for these trying to consolidate debt.

How Do Secured Loans Work?

When you're taking out a secured mortgage, the lender assesses the worth of your collateral. Based in this contrast and your potential to repay the mortgage (which include reviewing your credit score heritage), they can confirm how so much you may borrow and at what pastime charge.

The Role of Collateral in Secured Loans

Collateral is predominant in securing a personal loan. It minimizes menace for lenders; in the event you default on repayments, they've the accurate to assert and promote your asset to recuperate their losses. This association permits creditors to be extra lenient with borrowers who have terrible credit histories.

Debt Consolidation: What Is It?

Understanding Debt Consolidation

Debt consolidation is the job of combining assorted bills right into a unmarried mortgage or cost plan. Instead Bad Credit Secured Loans of juggling varied per thirty days bills with other due dates and passion quotes, consolidating your debts simplifies your economic duties into one doable cost.

Why Consider Debt Consolidation?

Consolidating debt can bring about numerous blessings:

- Lower Interest Rates: By simply by a secured mortgage, property owners might also cozy scale back attention fees in comparison to what they may be at present paying on their latest bills. Easier Management: One money means less tension and less chances of missing repayments. Improved Credit Score: Responsible reimbursement of consolidated money owed can bring about upgrades in credits scores.

Unlocking Financial Freedom: How UK Homeowners Can Use Secured Loans for Debt Consolidation, Even with Bad Credit

Homeowners inside the UK struggling with negative credit regularly suppose that their possibilities are restricted with regards to debt consolidation. However, secured loans provide a viable pathway towards accomplishing fiscal freedom. By leveraging abode fairness or different property as collateral, property owners can get right of entry to dollars that allow them to pay off top-interest debts whereas doubtlessly enhancing their universal financial crisis.

The Process of Applying for Secured Loans

Step 1: Assess Your Current Financial Situation

Before using for a secured mortgage, it truly is an important to perceive your present day economic status:

- List all impressive debts Calculate whole monthly payments Determine how so much equity you could have for your home

Step 2: Research Direct Lenders Offering Secured Loans

Finding direct creditors who focus on secured loans is prime. Unlike agents who also can price expenditures or add problems, direct lenders deal rapidly with debtors:

- Look on-line for legitimate lenders Check opinions and ratings Compare phrases and conditions

Step three: Prepare Documentation Required for Application

To observe correctly for a secured loan, practice helpful documentation resembling:

- Proof of profit (pay stubs or tax returns) Details approximately recent debts Information about your own home (appraisal or valuation)

Step four: Submit Your Application and Await Instant Decision

Many direct lenders now be offering an instantaneous resolution on applications. Once submitted:

- You may acquire conditional approval inside minutes. Lenders will behavior additional checks in the past finalizing any deals.

Interest Rates on Secured Loans: What To Expect?

Factors Influencing Interest Rates

Interest fees on secured loans can vary generally based on several causes which includes:

Credit History Loan-to-worth Ratio (LTV) Market ConditionsComparing Interest Rates Across Different Lenders

It's simple to compare charges from more than a few creditors in view that rates can substantially vary:

| Lender | Interest Rate | Fees | Approval Time | |---------------|---------------|-------------|---------------| | Lender A | 4% | £500 | Instant | | Lender B | five% | £three hundred | 24 hours | | Lender C | 7% | £six hundred | Instant |

The Pros and Cons of Secured Loans for Debt Consolidation

Advantages of Using Secured Loans

Lower Interest Rates as compared to unsecured chances. More available approval inspite of terrible credit. Potentially upper borrowing amounts.Disadvantages of Using Secured Loans

Risk of shedding your asset when you default. Possible added rates associated with remaining expenses. Extended reimbursement terms most popular to more accrued pastime over the years.Understanding Bad Credit and Its Implications on Loan Applications

What Constitutes Bad Credit?

Bad credit mostly refers to having a low credits score because of overlooked funds or defaults on prior loans.

How Bad Credit Affects Borrowers’ Options

Low credit score scores minimize borrowing possibilities considerably; besides the fact that children:

Some creditors specialize in featuring merchandise tailor-made for humans with negative credit score. Alternatives like no credits inspect loans also exist yet would lift increased risks.No Credit Check Loans: An Alternative Option?

While no credits money loans may just look appealing by using quickly approvals devoid of assessing credit historical past, they generally come at prime rates:

Higher curiosity prices than usual secured loans. Shorter repayment phrases most effective to elevated per month bills.Frequently Asked Questions (FAQs)

FAQ 1: Can I get a secured mortgage if I even have horrific credit?

Yes! Many direct creditors offer secured loans exceptionally designed for americans with terrible credits.

FAQ 2: How quick can I be given payments after approval?

Once accredited, dollars from a secured loan are quite often allotted inside of days.

FAQ three: Is my homestead at possibility while disposing of a secured mortgage?

Yes, whenever you default on payments, you possibility losing your private home as it serves as collateral.

FAQ 4: Are there any prices related to acquiring a secured mortgage?

Yes, so much lenders fee charges akin to origination bills or appraisal prices which should still be seen while calculating overall fees.

FAQ five: Can I use my car as collateral other than my domicile?

Yes! Other resources like trucks can also qualify as collateral based on lender regulations.

FAQ 6: Will my utility get rejected if I’ve had prior defaults?

While beyond defaults impression purposes negatively, a few creditors take into accout typical conditions as opposed to simply beyond error.

Conclusion

In precis, unlocking financial freedom using secured loans offers an invaluable alternative for UK house owners confused via loan debt and deficient credit rankings alike. By consolidating present accounts into one manageable settlement by using these sorts of loans—even with out ideal credit score—debtors stand poised no longer handiest regain manage over their funds however also pave the method towards enhanced stability transferring ahead! Whether you're curious about recent alternatives readily available or waiting dive headfirst into this invaluable course of—there's not at all been more advantageous time beginning exploring what those high-quality gear have offer!